Table of Contents

Anna Coulling in her book A Complete Guide to Volume Price Analysis teaches traders how to read the market using the combination of volume and price action. This book is built on the principles of Richard Wyckoff’s method and explains how analyzing the interplay of volume and price movements can provide deep insights into market trends, reversals, and smart money activity.

This article explores the foundational principles of Volume Price Analysis, core concept, and market structure and Wycoff method discussed in her book.

Understanding Volume Price Analysis (VPA)

Richard Wyckoff was the first among those who emphasized on importance of volume in market analysis. His initial works has been interpreted by different writers. Anna Coulling’s Volume Price Analysis is among the Wyckoff’s interpretation. According to Anna, VPA helps traders see beyond price action alone. This also helps understanding market manipulation.

However, in order to understand VPA, one must understand that volume is the fuel that drives market movement. Price moves by executing market orders and the purpose of price movement toward specific levels includes the execution pending orders (buy stops and sell stops). Both of the execution of order generate volume in the market. As a volume trader, we craft insights based on available data.

Financial markets are manipulated by institutional traders. There comes another reason which makes the volume important for trading. Manipulation in market is common. Volume can be used to understand their footprints. The combination of price and volume provides clues about future price movements.

Guiding Principles of Volume Price Analysis

Anna Coulling’s approach to Volume Price Analysis (VPA) is built upon key principles that have been refined over her 16 years of experience. These principles are not rigid rules. However, these are the guiding points that help traders navigate financial markets using the VPA methodology. Understanding these principles is essential to consistently applying VPA in real-world trading.

Principle No. 1: Art, not Science

Like other trading strategies and concepts, VPA is an art rather than a precise science. Volume Price Analysis involves interpretation of price movements in relation to volume. This approach to market analysis is highly subjective and requires experience and practice.

One of the foundational reasons, according to Anna Coulling, it cannot be automated because the software lacks the ability to apply human judgement to price and volume relationship. Traders must analyze price behavior, and then compare it to associated volume. Here we have to collects confirmations and anomalies. Human ability to access context in financial market requires extensive experience.

Principle No. 2: Patience

Traders often make the mistake of entering positions too early when they see a potential reversal signal. Patience is the key for success in trading VPA. Financial markets have momentum that does not immediately reverse based on a single signal. However, these signals indicate the beginning of a shift, not an instant turnaround.

One notion that must be remembered that the market needs time to absorb excess supply or demand before a confirmed reversal takes place. This principle can helps VPA traders improve their trading psychology and trade maturely instead of emotionally.

Principle No 3. It’s all Relative

Volume analysis is a relative measure rather than an absolute one. Many traders become obsessed with the accuracy of their volume feed, worrying about differences between brokers or platforms. However, these minor discrepancies do not impact VPA significantly because traders are only comparing volume bars within their own data set.

Each broker may have slightly different volume data due to variations in order flow, data aggregation, and feed timing. Comparing one broker’s volume feed to another’s is irrelevant because VPA works by comparing one volume bar to previous volume bars within the same feed.

What matters is consistency. If a trader uses the same data feed consistently, the relative volume comparisons remain valid. This realization saves traders a significant amount of time and frustration, allowing them to focus on applying VPA instead of questioning their data.

Principle No 4. Practice Makes Perfect

It is a universal principle that proficiency in any skill comes with practice. This also applies to VPA. The ability to interpret volume in relation to price takes time to develop. However, once learned, it becomes second nature.

VPA applies to all timeframes, whether a trader is looking at long-term investment decisions or short-term scalping strategies. An investor analyzing weekly or monthly charts will use the same principles as an intraday trader analyzing minute-by-minute price movements.

Traders should dedicate time to reviewing historical charts and practicing their analysis in live markets. Over time, they will begin to recognize patterns more quickly and accurately, allowing them to anticipate market movements with greater confidence.

Principle No. 5: Technical Analysis as a Complement

Volume Price Analysis is not a standalone strategy. As a trader, it would be best if combined with other strategies and concepts. From supply and demand concepts to SMC and ICT concepts, it can be used with all strategies and technical tools.

Principle No. 6: Validation or Anomaly

When analyzing the market using VPA, traders are always looking for one of two conditions: validation or anomaly.

Validation occurs when volume confirms price action. For example, if prices rise and volume increases, the upward movement is validated. Conversely, if prices fall with increasing volume, the downtrend is confirmed.

Anomaly occurs when volume does not support price action. If prices rise but volume declines, it signals weakness in the uptrend, suggesting a potential reversal. Similarly, if prices fall on decreasing volume, it indicates that selling pressure is drying up, increasing the likelihood of a reversal.

Traders should constantly assess whether volume is supporting or contradicting price movements. By identifying these patterns, they can anticipate potential market reversals or continuations before they happen.

The Core Principle of VPA

Its basic premise is focusing on volume and price relationships:

- If price is rising with rising volume, this gives strong confirmation of the trend.

- If price is rising with falling or decline in volume, this signals a weakening of the trend. There is a possible reversal ahead. This type of Volume-price relationship is known as volume divergence.

- If price is falling with rising volume, this gives strong confirmation of the bearish sentiment.

- If price is falling with falling volume, this signals a weakening of the bearish trend. There is a possible reversal ahead. There is no confirmation that is why it is knows as volume divergence in bearish scenario.

Market Structure and Wyckoff Method

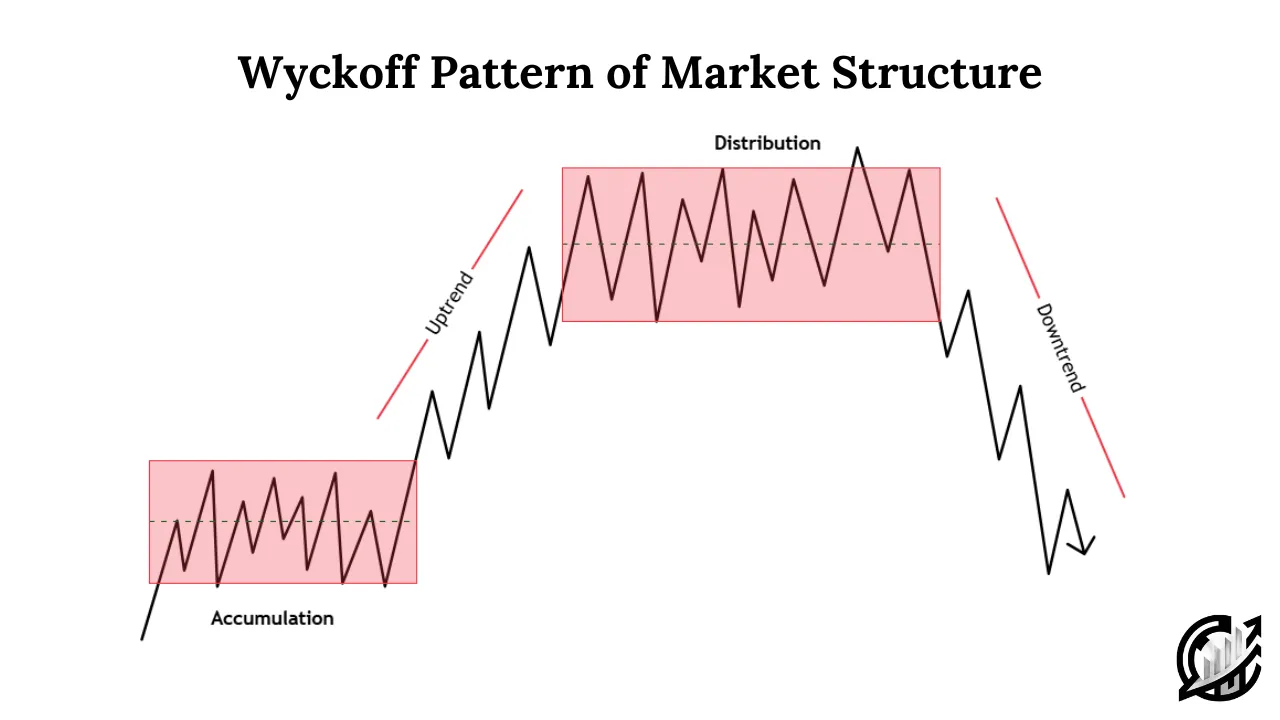

Their studies are highly influenced by Wycoff trading concepts. Wyckoff trading method is a classical approach that categorizes market movements into four key phases: Accumulation, Markup, Distribution, and Markdown.

In Accumulation phase of the market, smart money is buying. According to VPA, volume is increasing in this phase but price movement is choppy. This choppy price movement with increasing volume is not normal and indicates institutional intervention.

As the institutions accumulate, the uptrend begins and smart money pushes prices higher. Volume in markup phase must be high. This high volume confirms the trend strength.

As the price reaches to its peak and price movement lacks strength, smart money starts distributing at these high prices.

After distributing heavily at those price levels, the market moves into a downtrend as selling accelerate and volume increases.

According to Anna Coulling, understanding these phases can help traders avoid traps set by institutions and identify early trade entry opportunities.

Final note

Volume Price Analysis is a mere analysis of traditional Wyckoff trading concepts. It is a powerful tool that enhances market understanding. However, like all trading methods and techniques, it does not guarantee success in trading. The principles shared in Anna’s Book and in this article are meant to guide your learning and practice. It is not a financial advice. Trading carries financial risk, and past performance is not indicative of future results. Always use proper risk management and never trade with the capital that you cannot afford to lose.

FAQs

What is Volume Price Analysis (VPA)?

Volume Price Analysis is a trading methodology that analyzes the relationship between volume and price action to identify market trends, reversals, and institutional activity. It provides deeper insight into what is truly happening behind the price movements.

Can VPA be used in all markets and timeframes?

Absolutely. VPA works across all financial markets—including stocks, forex, commodities, and indices—and is effective on all timeframes, from tick charts to monthly charts.

How accurate is tick volume in the forex market?

While tick volume isn’t a direct measure of real volume, it reflects activity and is consistent on the same platform. It’s highly effective when used with VPA as long as you’re comparing bars from the same data feed.

I’m Abdullah Shah, a content writer with three years of experience in crafting engaging and informative content. My background in market analysis complements my work, allowing me to create content that resonates with audiences. I’m also a seasoned practitioner in the forex and crypto markets, with a strong foundation and deep interest in finance. My passion for the financial world drives me to produce content that is both insightful and valuable for those interested in understanding market trends and financial strategies.