Table of Contents

Wyckoff studies are primarily focuses on price and volume relationship. Volume Spread Analysis is a powerful method that evaluates the relationship between volume and price. According to Tom Williams, the relationship between volume, price spread, and closing price is used to identify true intentions of institutional traders. Institutional traders’ techniques and concepts are often referred to as smart money trading techniques.

This article explores the understanding and definition of bullish and bearish volume, its importance, identification, and the concept of background strength and weakness.

Understanding Bullish and Bearish Volume

Like price action and time, volume is considered as an important concept in trading. It reflects level of participation and conviction behind price movement. In VSA, bullish and bearish volume are defined based on how volume behaves during up-moves and down-moves.

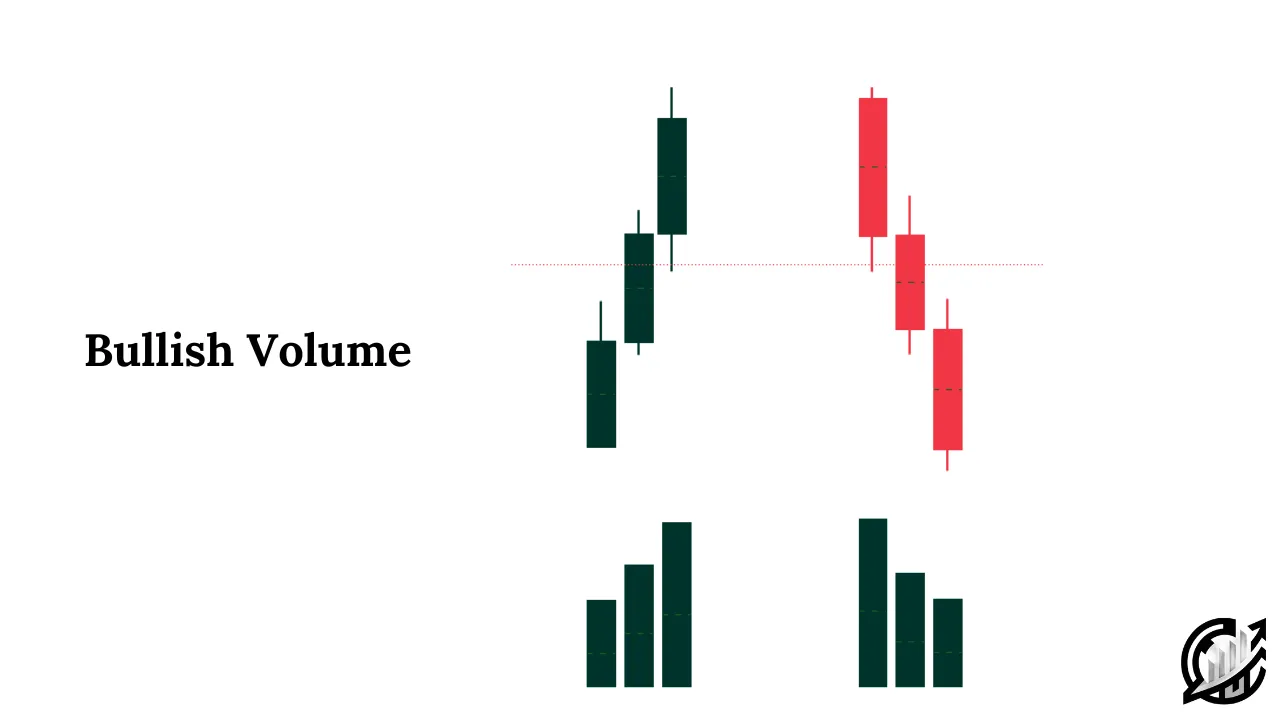

In VSA, Bullish volume occurs when volume increases during up-moves and decreases during down-moves. This type of behavior suggest that demand is present, and that professional traders and their intervention in market are supporting the price movement. A wide price spread on an up-close candlestick with increasing volume confirms strong buying interest.

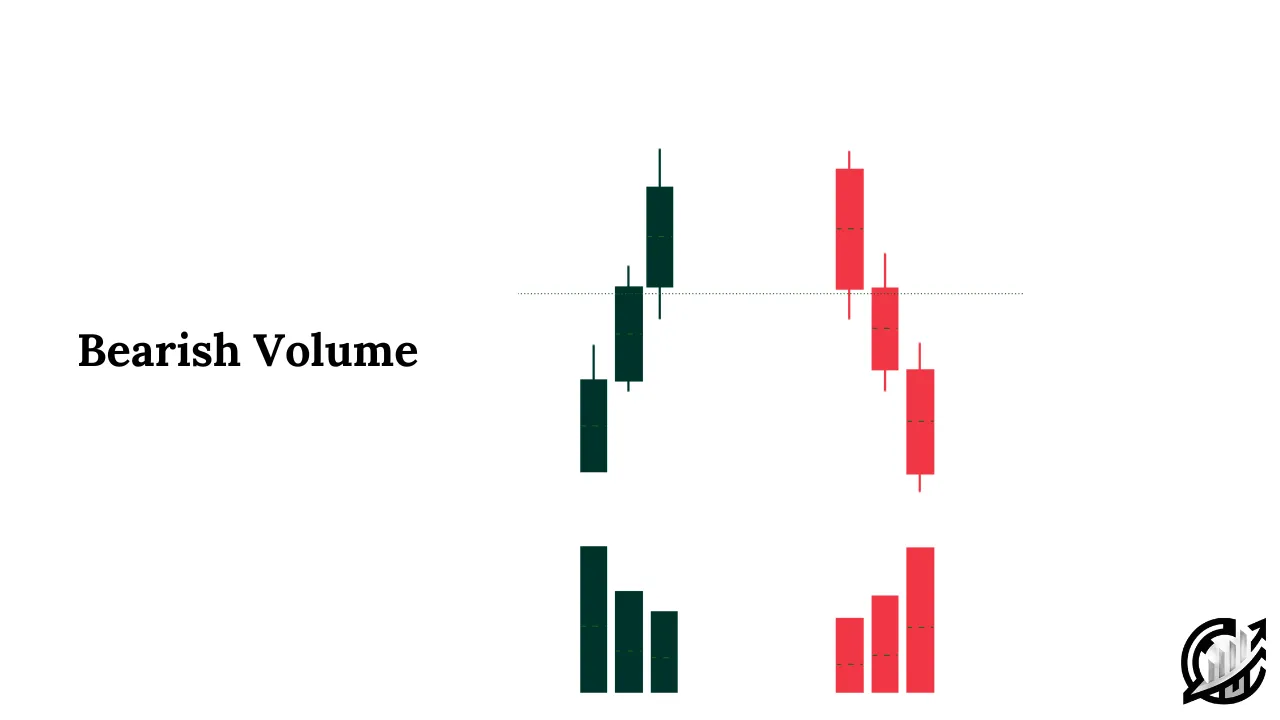

In VSA, Bearish Volume is observed when volume increases during down-moves and decreases during up-moves. This type of behavior of price and volume signals that selling pressure is dominant and that smart money is distributing their holdings. A wide spread on down-close candlestick with increasing volume confirms strong selling pressure.

These definitions provide basic premise of bullish and bearish volume. It is advised not to build trade decisions by using only the definitions. Traders must analyze other factors of technical analysis and VSA to determine whether a move is genuine or manipulated by market makers. Additional confirmations can be used to avoid false signals and align their trades with smart money.

Identification of Bullish Volume

In trading VSA, Bullish Volume indicates buying pressure and the intervention of smart money supporting the bullish move. However, it is crucial for traders to recognize and differentiate between true bullish volume and smart money traps that are designed to mislead retail traders.

Characteristics of Strong Bullish Volume

In order to confirm a strong bullish trend combined with volume, a trader must look for the following things:

- An increase in volume on up-moves confirms that demand is pushing the price higher.

- A decrease in volume on down-moves signals that sellers are exhausted. In these scenarios, we can draw conclusion that smart money is no longer interested in selling at lower prices.

- Wide price spreads on up-close candles with closing near the high signal that buying pressure is dominant.

Fake Bullish Volume (Institutional Traps)

Generally, in trading, it is important to recognize the fact that not all up-moves are genuine and reliable. Smart money often traps traders by creating the illusion of strength. Volume can help understanding the fake bullish moves. The following are the common signs of fake bullish volume:

- If price rises but volume declines, it indicates that institutions are not interested in taking the price higher. This is an indication of weak uptrend.

- If volume increases but the price spread remains small, it indicates that supply (selling pressure) is present. This also suggest that sellers are distributing their positions.

- Lastly, if price creates a wide spread up-close candle with high volume but a close near the low, it would be referred to as classic sign of weakness. It indicates selling pressure.

Background confirmation

The reliability of a bullish move is highly dependent upon the background of price action.

If background strength is present in the form of signs of strength and previous accumulation, the bullish move is likely to be genuine. For example, if an asset has strong buying activities and sign of strengths in the background, up-move with increased volume is another confirmation of trend continuation.

On the other hand, if background weakness is present in the form of sign of weakness and distribution signs, bullish moves are likely to fail.

Identification of Bearish Volume

In trading VSA, Bearish Volume indicates selling pressure and the intervention of smart money supporting the bearish move. However, it is crucial for traders to recognize and differentiate between true bearish volume and smart money traps that are designed to mislead retail traders.

Characteristics of Strong Bearish Volume

In order to confirm a strong bullish trend combined with volume, a trader must look for the following things:

- An increase in volume on down-moves confirms that sellers are pushing the price lower.

- A decrease in volume on up-moves signals that buyers are exhausted. In these scenarios, we can draw conclusion that smart money is no longer interested in buying at higher prices.

- Wide price spreads on down-close candles with closing near the low signal that selling pressure is dominant.

Fake Bearish Volume (Institutional Traps)

Generally, in trading, it is important to recognize the fact that not all down-moves are genuine and reliable. Smart money often traps traders by creating the illusion of weakness. Volume can help understanding the fake bearish moves. The following are the common signs of fake bearish volume:

- If price declines and volume declines, it indicates that institutions are not interested in taking the price lower. This is an indication of weak downtrend.

- If volume increases but the price spread remains small, it indicates that demand (buying pressure) is present. This also suggest that buyers are accumulating their positions.

- Lastly, if price creates a wide spread down-close candle with high volume but a close near the high, it would be referred to as classic sign of strength. It indicates buying pressure.

Background confirmation

The reliability of a bearish move is highly dependent upon the background of price action.

If background strength is present in the form of signs of weakness and previous distribution, the bearish move is likely to be genuine. For example, if an asset has strong selling activities and sign of weaknesses in the background, down-move with increased volume is another confirmation of trend continuation.

On the other hand, if background strength is present in the form of sign of strengths and accumulation signs, bearish move is likely to fail.

Importance of Context in VSA

In technical analysis, it is crucial for traders to consider the overall picture of the market. Never ignore the bigger picture of the market. Market is an on-going story where each price movement is influenced by past price action, volume, and the involvement of smart money.

Context in trading is crucial because smart money manipulates price action to mislead retail traders. Manipulation occurs in the form of false breakouts, traps, and fake trends before making the actual trend.

Past price action and bigger picture helps us in filtering the traps. Manipulation on smaller timeframes are legitimate moves higher timeframes. That is why it is advised to consider three timeframe for your trading.

Final Note

Understanding the nature of volume is the first aspect of volume spread analysis. Identification of genuine bullish and bearish volume requires analyzing volume, price spread, closing price, and market background. These are the VSA principles that traders can use to distinguish between real market moves and smart money traps. Remember, nothing can minimize the risk of financial markets. It is advised to trade with the capital that you can afford to lose. This methodology can improve your trading ability but never guarantee ultimate success in trading.

FAQs

What is Bullish Volume in VSA?

Bullish volume occurs when volume increases on up-moves and decreases on down-moves. This indicates that demand is present, and smart money is accumulating positions in anticipation of higher prices.

What is bearish volume?

Bearish volume occurs when volume increases on down-moves and decreases on up-moves. This indicates that supply is dominating and institutions cold be distributing positions before a downtrend.

I’m Abdullah Shah, a content writer with three years of experience in crafting engaging and informative content. My background in market analysis complements my work, allowing me to create content that resonates with audiences. I’m also a seasoned practitioner in the forex and crypto markets, with a strong foundation and deep interest in finance. My passion for the financial world drives me to produce content that is both insightful and valuable for those interested in understanding market trends and financial strategies.