Table of Contents

In market structure analysis, understanding swing low are important. This helps understand market structure trend. An important point is that we have to get an idea of strong and weak low. This concept can used to mark entries and exits. Understanding and analyzing structure in forex market is highly dependent on understanding strong and weak lows.

Along with that this helps in identifying underlying strength or weakness of buyers in any price movement. These concepts help traders recognize whether the market is likely to continue its uptrend or downtrend.

This article discusses the understanding of strong and weak low, its identification and trading with strong and weak low.

Understanding Strong and Weak Low

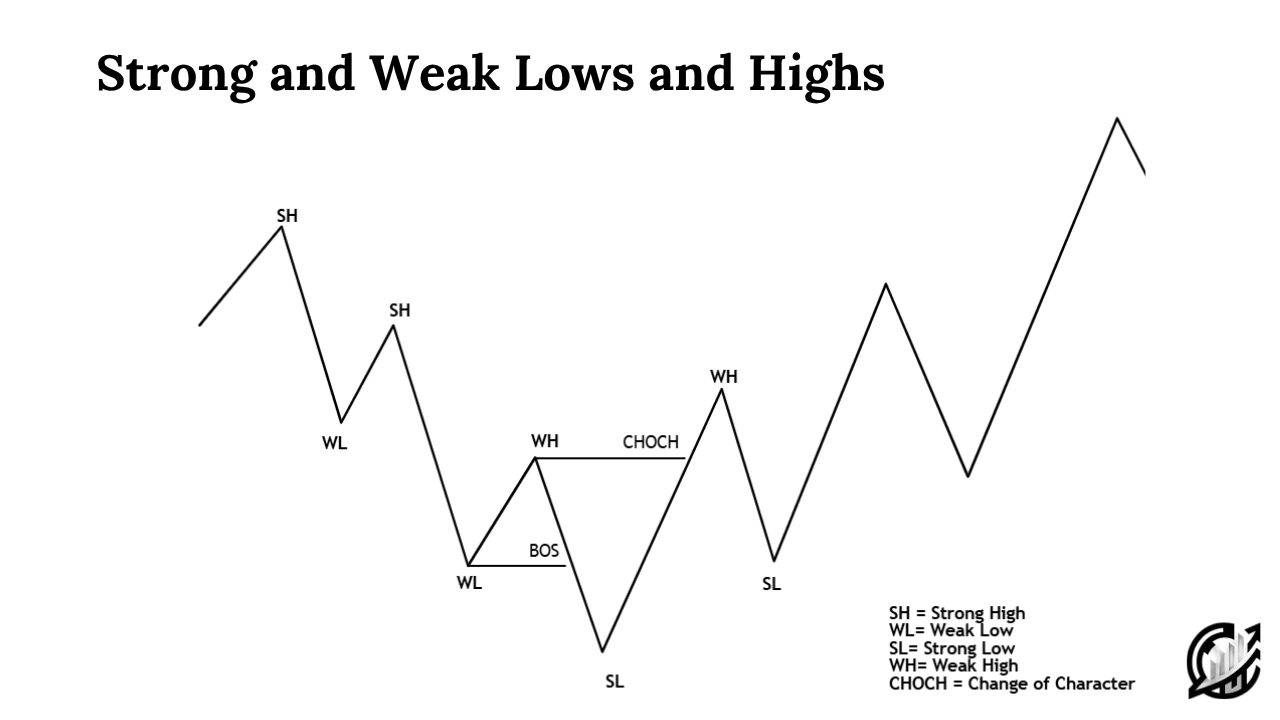

A strong low is a recent swing low on a price chart that acts as a foundation for a bullish market shift. When price forms this low, the subsequent upside move must be powerful enough to break the previous swing high or clear resistance zone. This Change of Character transforms a simple low into a strong one. The broken strong high transformed into a weak high. It is considered as a sign that buyers have stepped in and absorbing sell-side liquidity.

For example, imagine a market in a downtrend forming a lower lows and lower highs. Suddenly, price creates a deep low and begins rally strongly. If this rally breaks above the last lower highs, it signals a CHOCH. This indicates that bullish control is emerging.

A weak Low fails to generate same decisive response from buyers. When price forms a swing low but the retracement move does not break the previous high or any significant resistance, it is labeled as weak low. This is because when market moves in its intended direction, it breaks the swing low.

Weak lows often act as liquidity magnets. They indicate indecision or temporary relief from selling pressure. This retracement move does not have enough momentum for a full bullish reversal.

Why Difference Between Strong and Weak Low Matters

Understanding the difference is far more than just a technical observation. It is an important element in making trading decision. Understanding and recognizing the strength and weakness of a low help traders align with market momentum rather than fight against it.

Bias and Decision-Making

An important reason lies in market directional bias. It is important for trader to build directional bias and must have an idea when the bias in going to change. When a strong low forms, it signals that buyers have taken control and the structure has shifted from bearish to bullish. This information can be used to adopt a bullish bias.

On the other hand, when a weak low is identified, it suggests that the market’s upward attempt lacks strength. From this we can get the conclusion that price is still within a bearish structure. Any rally or correction could be simply a temporary one.

Risk Management

Strong and week low directly affect risk management. A strong low provides a clear structural reference point for stop-loss placement. This is because after shift in market structure, traders can confidently position stops just below the strong low. There is high chance that the market continues its bullish narrative.

On the other hand, trading weak low involves greater uncertainty. It is better to avoid trading week lows until you found a confirmation signal in the form of shift in market structure.

Strategy Selection

The distinction between strong and weak low helps you choose the right trading strategy for the environment. If you are a trend following trader, it would be better to take short bear strong highs and target weak lows.

On the other hand, it is recommended to wait for shift in market structure. This converts strong high into a weak one. There you can wait for retracement near the strong low and target the weak high.

No matter which strategy you want to use for profitable trading, first you should read your nature. Strategy selection is highly dependent on your inner nature.

Psychology behind Strong and Weak Low

From a psychological standpoint, a strong low represents institutional buying activity or heavy accumulation. It is swing low where smart money accumulates orders. After filling their inventories, large buy orders push the price higher, breaking through prior resistance levels. You can set strong low as a reference point for future trades.

Psychologically, weak low represents retail participation without institutional follow-through. Buyers step in expecting a reversal, but institutions have not confirmed the move, the market remain weak. Over time, price sweep these lows creating inducement before a genuine low is established.

Identification of Strong and Weak Lows

It is a process of observing price structure, confirming with other technical tools and validating across timeframes. You should be cautious when analyzing structure with respect to strong and weak lows.

Structural Rules

On your chart, draw the recent swing low and the prior swing high. It defines the existing structure. This gives you exact levels to monitor.

If price rallies and closes above the prior swing high, that is the potential shift in market structure. Remember emphasize on closes rather than wicks. A wick break without close is not considered as valid break.

A single close above the high is good, but real conviction usually comes with continuation. If price pushes higher and prints higher highs, treat the low as strengthening.

After the breakout, market retests the level near the new strong low. If the bounce stalls well below the prior swing high, forms lower highs, or reverse to break the low, label it weak.

Multi-Timeframe Confirmation

It is recommended to check at least one higher timeframe. A move that break its structure on a 15-minute timeframe but remains within a down-structure on the 4-hour or daily chart is weak.

Higher timeframe is used to confirm broader bias. if the lower timeframe shows strength but the higher timeframe is neutral, consider smaller position sizes or wait for confirmation. If both aligns bullish, you can be more aggressive.

Final Note

Having an idea of strong and weak low is vital for identifying true market structure shifts and avoid false reversals. However, there is no guarantee for one hundred percent success. Market can behave unpredictably due to liquidity, volatility, and macro events.

Trading involves substantial risk and past performance or signals do not ensure future results. Always risk the capital that you can risk to lose. This educational content is for informational purpose only and does not constitute financial advice.

FAQs

What is a Strong Low in Trading?

A strong low in trading is a swing low that leads to a shift in market structure to the upside. It indicates that buyers have gained control, pushing price higher above the previous highs. This structural shift often signals a potential bullish reversal.

What is a Weak Low in Trading?

A weak low is a swing low where the upward movement fails to break previous highs or resistance. It shows weak bullish momentum and suggests a trend continuation to the downside.

How to identify a strong low using price action?

You can identify a strong low when price forms a swing low and then rallies strongly to close above the previous swing high, confirming a break in market structure.

How to identify a weak low on a chart?

A weak low is identified when the market forms a swing low, but the subsequent upward move fails to close above the previous high.

I’m Abdullah Shah, a content writer with three years of experience in crafting engaging and informative content. My background in market analysis complements my work, allowing me to create content that resonates with audiences. I’m also a seasoned practitioner in the forex and crypto markets, with a strong foundation and deep interest in finance. My passion for the financial world drives me to produce content that is both insightful and valuable for those interested in understanding market trends and financial strategies.