Last Updated on December 1, 2025

Table of Contents

Understanding market structure is a little bit confusing. There are a lot of reasons but one of them is confusion among smart money concepts. Some of the concepts are similar in nature but their names often confuse traders. Like Break of Structure and Market Structure Shift, these two concepts are different in nature.

This article explores the underlying difference between MSS vs BOS, what create confusion and how to spot the right on price chart.

MSS vs BOS

In Price action and smart money concepts, structure defines everything. It tells us about the trend of the market whether the market is trending, consolidating, or preparing for a potential reversal. These two concepts are most discussed concepts in SMC trading.

These two concepts appear similar on charts but they represent two very different phases of price behavior and institutional activity. Understanding the contrast between MSS vs BOS helps trader separate continuation from reversal

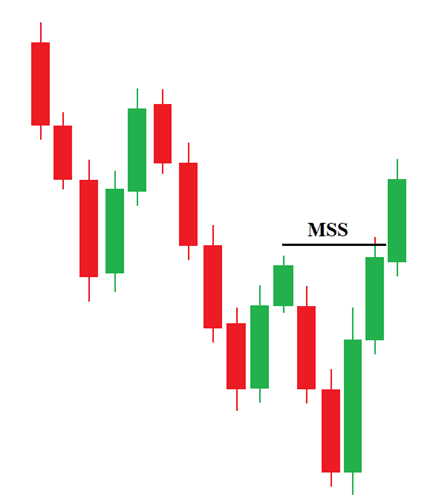

Market Structure Shift (MSS)

MSS signals that the trend is changing its direction. It presents a transition in the market’s delivery from bullish to bearish or bearish to bullish. An MSS appears after a liquidity grab. However, the defining feature of MSS is a decisive displacement that break the opposite swing in the structure.

MSS confirms when a strong displacement candle that breaks a significant swing in the opposite direction. A clear sweep of liquidity before the reversal strengthens MSS. In simple words, MSS signals a potential reversal.

Break of Structure (BOS)

A break of structure occurs when price violates a key swing low or high within an existing trend. It confirms that the market continues in its dominant direction. It can be bullish or bearish.

In a bullish or bearish environment, a BOS happen when the market forms a higher highs and higher lows, and price closes above a previous swing high.

In a bearish scenario, a BOS occurs when price closes below a previous swing low. The break must occur with candle body closure and it must align with higher-timeframe directional bias. BOS confirms trend continuation.

The Conceptual Difference Between MSS vs BOS

Although both MSS and BOS represent moments where price violates a previous structural level, but their underlying interpretation are entirely different. One confirms the current market trend, and other signals a shift in institutional order flow.

Understanding the deeper distinction between the two allows traders to recognize whether the market is continuing or changing direction.

Market Phase

The BOS belongs to a continuation phase of the market. It confirms that the exiting trend is still active and healthy. Each break of structure validates the order flow in the current direction.

On the other hand, the MSS marks the reversal phase. It is where a previously establish trend begins to lose strength and shift into a new direction. Its defining factor (displacement) reflects aggressive participation from institutions.

Candle Behavior

In an MSS, candles show aggressive displacement. This violence reflects a true change in control. While, a BOS produces impulsive but controlled candles. The movement beyond structure reflect institutional participation but remains orderly, confirming ongoing strength.

Directionality

In MSS, the direction changes. Price sweeps liquidity in the old trend’s direction, then breaks structure in the opposite direction. this signals that price has shifted into a new delivery phase.

In BOS, market direction is clear and consistent. A bullish BOS breaks previous high, while bearish BOS breaks previous lows, both supporting continuation of momentum.

Liquidity Behavior

A break of structure simply indicates trend continuation. Here liquidity dynamics defines the difference. A BOS may not involve liquidity grabs. Structure breaks occur even without taking equal highs or lows.

However, MSS has quite different liquidity behavior. MSS almost follows a liquidity sweep. The market hunt stops from the previous trend participants before reversing. This sweep is not random. It represents institutional inducement. These moves are designed to trap retail traders before the displacement confirms reversal.

Psychological Meaning

Understanding the psychological factor is crucial. The break of structure represents institutional continuation. The trend continuation simply supports the idea that smart money is adding to existing positions. They engineer pullbacks to fill orders before pushing further.

In contrast, the market structure shift reveals institutional transition. Smart money and institutions are closing previous positions and initiating trades in the opposite direction.

How MSS Develops After a BOS

In live trading markets, you should look for both of them. Understanding how MSS forms after a break of structure (BOS) is essential for interpreting the life cycle of a trend. In SMC, trends rarely reverse without creating a logical sequence of structural events.

A break of structure represents the continuation phase of a prevailing trend. When the market is bullish, price breaks the previous highs and forms higher high and higher low. In bearish market, it breaks previous lows and creates lower low and lower high. These price moves represent rhythm in price action.

Trends do not continue indefinitely. Before continuing its prior trend, the market often engineers liquidity traps known as inducements. Common inducements include: Equals highs or lows, trendline liquidity, minor swing points near an order block. Market often sweeps these liquidity pools before continuing its prior trend.

Market structure shift signals a trend reversal. This is where trend ends. In MSS, price shows an aggressive displacement against the prevailing trend. An MSS breaks a structural level in the opposite direction. In MSS there is a displacement of price in the opposite direction. You can notice this with large candle bodies breaking near swing low or swing high.

In simple words, a BOS strengthen the ongoing bias while MSS executes the reversal. It flips the direction of institutional order flow.

Trading the BOS Effectively

A BOS is meaningful when it aligns with the existing trend. Analyze the market on higher timeframe like 4h or daily. This confirms the bullish or bearish nature of the market. You must trade with the dominant institutional order flow.

You should wait for a clean structural break. A valid BOS must show a strong candle body closing beyond the prior swing high or low. It is recommended to avoid wick breaks because it can be liquidity hunts and often traps traders. A clear close confirms true continuation momentum and proves that institutions are still driving price in the same direction.

Traders who trade trend continuation enter on retracement. Instead of chasing the breakout, wait for a pullback into an FVG or order block. These zones can be used by traders to enter and trade with the trend and institutional order flow.

After taking logical entry, set a smart stoploss and take profit. Your stoploss should be near the major swing point and target logical liquidity pools.

Trading the MSS Effectively

Unlike BOS, an MSS requires displacement candle for a decisive shift in momentum. Price must break the opposite structural point with one or more strong-body candlestick. The displacement is the core of MSS identification.

Like a BOS, highest-probability MSS setups occur at higher-timeframe OBs, premium & discount zones, mitigation points or other PD arrays. When an MSS happens within a larger POI, the reversal becomes significantly more reliable.

Once displacement occurs, wait for price to retrace into the FVG or OB that caused the MSS leg. In retracement, you can find your trade entries depending on your trading setup.

MSS trades counter the existing trend, which makes them inherently riskier. Always use a smaller position size and confirmation-based entries.

Final Note

There is a little difference in BOS and MSS. Understanding the difference helps traders interpret trend continuation and reversal scenarios with greater accuracy. Remember, these concepts should be used within a complete trading framework. Always combine structure analysis with liquidity, higher-timeframe context, and disciplined execution.

Trading forex, crypto, and other financial markets carries huge financial risk. These concepts can help in understanding market structure but do not ensure profitability and should not be taken as financial advice. Market conditions can change rapidly and losses may occur.

FAQs

What is the main difference between BoS and MSS?

A break of structure confirms trend continuation, while a market structure shift signals a potential trend reversal. BoS aligns with existing institutional order flow, whereas MSS breaks structure in the opposite direction with aggressive displacement.

How to avoid false BoS and MSS signals?

The best way to avoid false signals is focusing on candlestick body closes, liquidity sweeps, and displacement. Trader should avoid reacting to wick breaks or shallow pullbacks. Along with that higher-timeframe context greatly reduces false signals.

Is MSS risker to trade than BOS?

Yes, MSS trades counter the existing trend, so they carry higher risk. MSS can provide early entries into major reversals with exceptional reward potential but requires strict validation.

I’m Aatiq Shah, a dedicated forex and crypto market practitioner with three years of hands-on experience. Currently, I’m working as a Financial Manager. My journey in the world of finance has equipped me with the skills and knowledge needed to navigate the complexities of the forex and crypto markets.