Table of Contents

Trading knowledge is relative in nature. Morning Star Pattern and Evening Star Candlestick patterns have their importance in trend reversal. Evening doji star candlestick pattern is much the same like Evening star pattern with little difference. As a trader, our only focus should be on what has happened in previous trend and what traces the institutions has left us that indicate trend reversal. This article explores definition, formation, psychology of the market, and additional consideration that can help us in digging out more market secrets.

Evening Doji Star

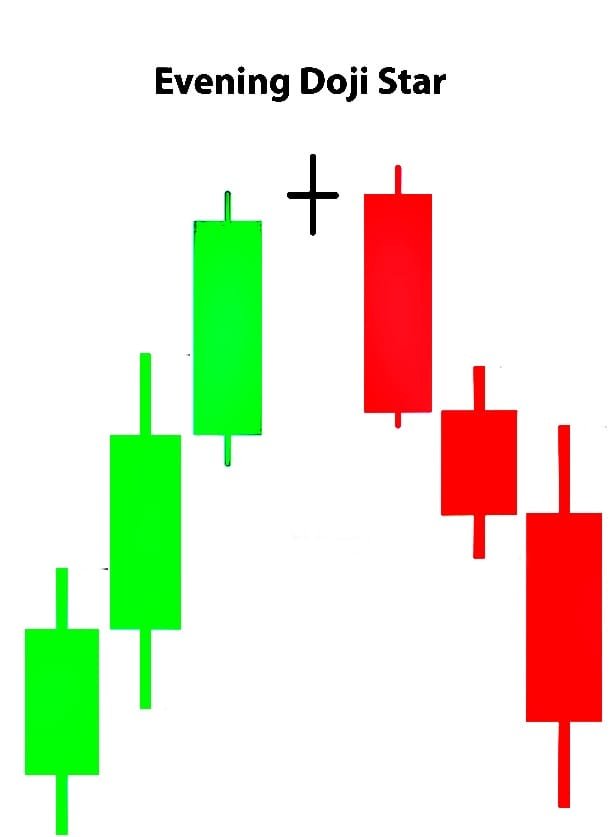

The Evening Doji Star candlestick pattern is a useful tool in technical analysis. This pattern signals a potential bearish reversal at the peak of an uptrend. Characterized by a three-candle formation, it reflects the market’s transition from bullish enthusiasm to indecision, and ultimately, to bearish control. This pattern is widely utilized by traders to anticipate the end of a bullish run and the beginning of a downward trend, making it an essential tool for identifying key turning points in the market.

Formation and structure of Evening doji Star

While analyzing candlestick chart, it is important to remember that not all candlestick patterns are useful for our analysis. There are rules that needs to be internalized before analyzing the chart. Otherwise, you’ll find well-known candlestick pattern on charts but they are not useful and lack predictive power. In Evening Doji Star, there must be clear prior uptrend in place. There are other important things like supply zone but having an uptrend is the fundamental thing.

Evening Doji star candlestick pattern forms in the following way:

- In an uptrend, strong bullish candle form that denotes strength of the trend. The body of the candle is long and denotes buyer domination in the market.

- The second candle holds importance. It is a Doji candle. If there is gapping up, it will be of more importance. However, this adds strength but this is not an absolute rule. In Intraday charts, there are no gapping up or down. Then, we combine multiple other things together to arrive at a result.

- Third candle is considered as a decisive candle. It is a long bearish candle. It denotes a change of interest from buyers to seller. One thing that we must consider in order to confirm the predictive power of the pattern is that the candle must cover 50% of the body of first candle.

As a trader we can add this in our trading arsenal but we must consider other things and market psychology and structure as a whole.

Market psychology

Market psychology plays a crucial role in the formation and interpretation of the Evening Doji Star pattern. This three-candlestick pattern encapsulates the shifting dynamics between buyers and sellers, providing insight into the emotional and psychological undercurrents of the market. Here is a detailed market psychology:

- From Optimism to Fear: The Evening Doji Star encapsulates a psychological journey from optimism to fear. Initially, the market is buoyed by bullish sentiment, but the appearance of the Doji introduces doubt. This doubt quickly turns into fear as the third bearish candle confirms the reversal. The pattern reflects how quickly market sentiment can shift, and how emotions like fear and greed drive market behavior.

- Confirmation and Momentum: Traders often wait for additional confirmation after the Evening Doji Star pattern forms, such as another bearish candle or other technical indicators signaling a reversal. Once confirmed, the psychological shift is complete, and the market typically enters a new phase dominated by bearish sentiment.

Understanding the market psychology behind the Evening Doji Star pattern helps traders grasp not just the technical signals but also the underlying emotional forces driving market movements. This insight is invaluable for making informed trading decisions, particularly in identifying key moments when the market sentiment is on the verge of a significant shift.

Key Considerations

A successful trader always combines multiple things and set up a trading strategy. Candlesticks are useful tool in market analysis but it generates limited insights. That is why multiples other things are considered which include indicators, price action (supply and demand zones), and volume confirmation. The following are the detailed approach to key considerations:

- Volume Confirmation: The volume of trading during the formation of the Evening Star pattern can provide crucial confirmation. Typically, higher volume on the third (bearish) candle indicates stronger selling pressure and reinforces the likelihood of a trend reversal. If the volume is low, the pattern might be less reliable, as it could signify a lack of strong conviction among sellers.

- Trend Context (Preceding Trend Strength): The Evening Star pattern is most effective when it occurs after a well-established uptrend. The longer and stronger the preceding uptrend, the more significant the Evening Star pattern becomes as a reversal signal.

- Proximity to Resistance (Supply Zone): The Evening Star pattern is more reliable when it forms near a significant resistance level. The third bearish candle breaking through or failing to surpass a key resistance level can strengthen the reversal signal.

- Overall Market Sentiment: Broader market conditions should be considered when trading the Evening Star pattern. For instance, if the overall market sentiment is bullish due to macroeconomic factors, the pattern might be less reliable. Conversely, in a bearish market environment, the Evening Star might indicate a stronger reversal.

- Market Type: The reliability of the Evening Star pattern can vary depending on the asset class. In stocks, the pattern might be more reliable due to the influence of corporate news and earnings reports. In Forex, where markets are driven by global economic factors, the pattern may require additional confirmation.

- Overall Market Structure: Overall market structure must align with your trading decision. If you are dealing with intraday, you HTF should favor your trading decision.

While the Evening Star pattern is a strong bearish reversal signal, its effectiveness depends on various factors, including volume, trend context, support and resistance levels, and market conditions. By considering these additional factors, traders can better assess the reliability of the pattern and enhance their trading strategies.

How to Trade the Pattern

Trading Evening Doji star candlestick pattern requires identification of the pattern accurately. Such pattern helps in precise entries and exits of the trade. In order to trade the market accurately, a trader performs the following actions:

- Identify the Pattern: First thing to ensure is a clear uptrend. Strong uptrend weakens as it develops. This is because market is driven by liquidity. Market must reverse in order to collect liquidity and decides what to do next. This could be our opportunity.

- Confirmation of the structure: The next thing is to look for bearish structure. In this case, such formation will be an edge for you.

- Confirmation of the signal: We can confirm the signal with volume analysis, indicators (like RSI or other momentum indicators), and with supply zones. If all are inline with our analysis. It would strengthen our psychology and adds objectivity in trading.

- Entry strategy: To reduce the risk of false signals, wait for a confirmation candle. This could be another bearish candle that closes lower than the third candle in the pattern. Enter the trade only after the confirmation candle closes below the third candle of the Evening Star pattern. This approach is safer but might result in missing part of the move.

- Stop-loss placement: Place a stop loss just above the high of the Doji (second candle) or above the high of the first bullish candle in the pattern. This placement minimizes potential losses if the pattern fails and the uptrend resumes.

- Profit targets: Set your initial profit target at the next significant support level. This is where the price might encounter buying interest, potentially halting the downtrend.

Imagine you identify an Evening Doji Star pattern on a daily chart of a stock that has been in a strong uptrend. After the third bearish candle forms, you confirm the signal with high volume and an RSI indicating overbought conditions. You decide to enter the trade at the open of the next day’s candle. You place your stop loss just above the high of the Doji candle and set a profit target at the next significant support level. As the trade moves in your favor, you trail your stop loss to lock in profits. Finally, you exit the trade as it approaches your target, securing a good risk-reward outcome.

Conclusion

Trading the Evening Star pattern requires a careful and disciplined approach, combining technical analysis with sound risk management strategies. By accurately identifying the pattern within a strong uptrend, confirming the signal with additional indicators and volume, and strategically entering and exiting trades, you can effectively capitalize on potential market reversals.

Frequently Asked Questions (FAQs)

What is an Evening Star Doji pattern?

The Evening Star Doji pattern is a bearish candlestick pattern that signals a potential reversal from an uptrend to a downtrend. It consists of three candles: a large bullish candle, a small indecisive candle (often a Doji), and a large bearish candle.

Is the Evening Star Doji pattern reliable on its own?

While the Evening Star pattern is a strong bearish signal, it is more reliable when confirmed by other indicators such as volume, RSI, or MACD. Waiting for a confirmation candle after the pattern forms can also increase its reliability.

Can the Evening Star pattern appear on any time frame?

Yes, the Evening Star pattern can appear on any time frame, from intraday charts to daily, weekly, or even monthly charts. However, it is generally more reliable on higher time frames like daily or weekly charts.

Can the Evening Star Doji pattern fail, and what are the reasons for failure?

There is no guarantee of success in evening star doji pattern. Like this pattern, every candlestick pattern can fail. These patterns can form in false breakouts, and with low volume. This affects the validity of evening star doji pattern. One more thing is that appearance of candlestick patterns must align with the market structure.

I’m Abdullah Shah, a content writer with three years of experience in crafting engaging and informative content. My background in market analysis complements my work, allowing me to create content that resonates with audiences. I’m also a seasoned practitioner in the forex and crypto markets, with a strong foundation and deep interest in finance. My passion for the financial world drives me to produce content that is both insightful and valuable for those interested in understanding market trends and financial strategies.