Table of Contents

SMC and ICT traders pay special attention to Reclaimed Order Blocks. Among other types of Order Block, Reclaimed Order Blocks are important in anticipating market direction. In ICT trading, Reclaimed OBs are dependent upon market maker model. For this one must have a thorough understanding of ICT Buy Market Model and ICT Sell Market Maker Model.

This article explores understanding of ICT Reclaimed Order Blocks, its formation in bullish and bearish market structure, and trading with reclaimed blocks.

Understanding ICT Reclaimed Order Blocks

In ICT and SMC trading, Reclaimed OBs are important zones where institutions and smart money strategically accumulate or hedge their positions. These Blocks show minor displacement or reaction in price. True importance of Reclaimed Blocks emerges when these blocks are reclaimed.

There are two sides of the market: Buy side of the curve and Sell side of the curve. Reclaimed Blocks within the framework of these curves is key to interpreting smart money behavior. Buy side of the curve represents market’s upward movement where price capture liquidity above the previous highs and inverse in the case of Sell side of the curve. Within this flow of price action, reclaimed blocks are crucial zones where institutions accumulation of orders occurs.

In Market Maker Buy Model (MMBM), Reclaimed Blocks typically form on the Sell Side of the Curve. Reclaimed zone are the areas where institutions and smart money accumulate their buy orders. Mechanism behind this ensures institutional traders secure favorable buy prices while engineering liquidity collection on the sell side.

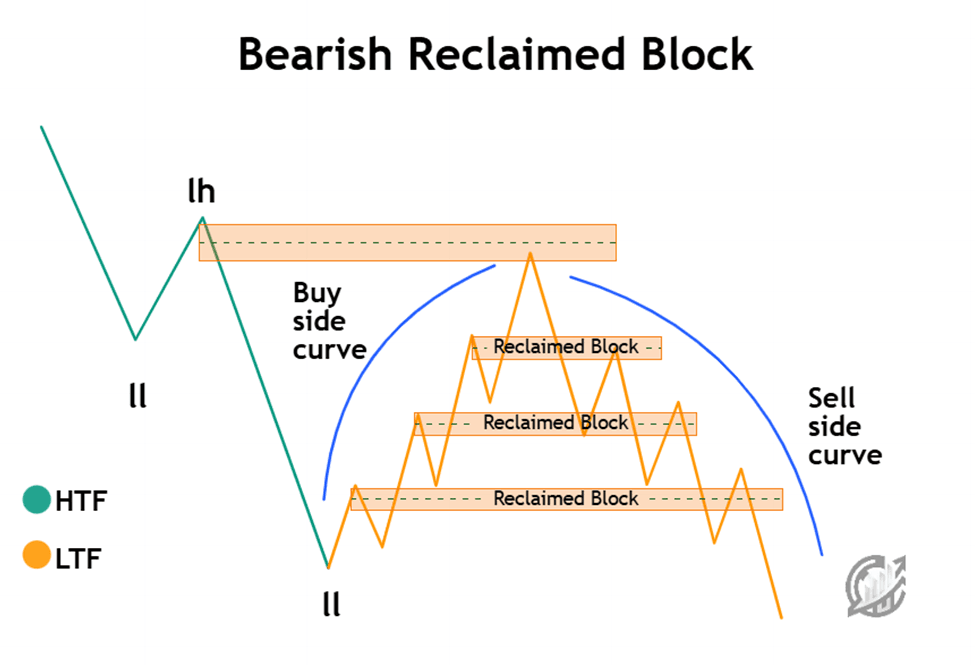

In Market Maker Sell Model (MMSM), Reclaimed Blocks typically form on the Buy Side of the Curve. Reclaimed zone, in this case, are the areas where institutions and smart money accumulate their sell orders. Mechanism behind this ensures institutional traders secure favorable sell prices while engineering liquidity collection on the buy side.

ICT Bullish Reclaimed Order Block

A Bullish Reclaimed OB is a last down-close candlestick before minor displacement. It is found on the sell side of the curve in a bullish market structure. This type of Order Block reflects institutional traders’ accumulation of buy positions which becomes evident when price reacts and move higher. Notion behind the concept is that institutional buy orders are huge in number and cannot be executed in single order. They plan their accumulation of buy orders. Reclaimed OBs reflects Smart money entries in the market.

In Buy side of the curve, these old blocks are reclaimed longs. Bullish Reclaimed OBs are identifiable after a short-term bounce or reaction at the initial zone. This represents minor displacement and confirm its relevance. When the market prepares to approach a higher timeframe PD Array, the bullish reclaimed act as a launching pad for the price to move higher.

Remember that you must have to be clear about market structure and highlight important supply and demand zones on higher timeframe. According to ICT, market moves lower in order to move higher. In the sell side of the curve, market accumulate buy orders. When market reaches to HTF PD Array, it gives reaction and starts to move higher. This is a shift of market from sell side of the curve to the buy side of the curve. It is a corner stone of Market Maker Buy Model (MMBM).

This is a power tool for understanding institutional behavior in the MMBM. It bridges the gap between liquidity engineering and directional bias. Bullish Reclaimed is high-probability zone to align their strategies with smart money.

ICT Bearish Reclaimed Order Block

A Bearish Reclaimed OB is a last up-close candlestick before minor displacement. It is found on the buy side of the curve in a bearish market structure. This type of Order Block reflects institutional traders’ accumulation of sell positions which becomes evident when price reacts and move lower. Notion behind the concept is that institutional sell orders are huge in number and cannot be executed in single order. They plan their accumulation of sell orders. Reclaimed OBs reflects their entries in the market.

In sell side of the curve, these old blocks are reclaimed shorts. Bearish Reclaimed OBs are identifiable after a short-term bounce or reaction at the initial zone. This represents minor displacement and confirm its relevance. When the market prepares to approach a higher timeframe PD Array, the bullish reclaimed act as a launching pad for the price to move lower.

Remember that you must have to be clear about market structure and highlight important supply and demand zones on higher timeframe. According to ICT, market moves higher in order to move lower. In the buy side of the curve, market accumulate sell orders. When market reaches to HTF PD Array, it gives reaction and starts to move lower. This is a shift of market from buy side of the curve to the sell side of the curve. It is a corner stone of Market Maker Sell Model (MMSM).

This is a powerful tool for understanding institutional behavior in the MMSM. It bridges the gap between liquidity engineering and directional bias. Bearish Reclaimed is high-probability zone to align their strategies with smart money.

Final Note

Like other types of Order Blocks, reclaimed block is a powerful concept because of its underlying logic. Trading with types of Order Blocks helps in unfolding hidden trading opportunities, but it never guarantees success. This is because there are other numerous unpredictable factors in trading. Smart money trader must combine this concept with other concepts in order to purify trading.

Remember, trading financial markets carries significant risk and it is not suitable for all investors. Past price action can help in understanding market behavior but does not guarantee future results. Always approach market practitioner and trade at your own risk.

Frequently Asked Questions (FAQs)

What is a Reclaimed Order Block?

In ICT and SMC trading, Reclaimed Order Blocks are important areas where institutions and smart money strategically accumulate or hedge their positions. These Blocks show minor displacement in price. True importance of Reclaimed Blocks emerges when these blocks are reclaimed.

What is a difference between Reclaimed Order Block and a regular Order Block?

A regular Order block is an area on a price chart that marks institutional buying or selling activity and is expected to act as support or resistance. On the other hand, a reclaimed order block is a previously invalidated zone that becomes valid after price action returns to it and starts respecting it.

What timeframes are best for trading reclaimed order blocks?

Higher timeframes are more reliable for using Order Blocks in trading. Higher timeframes like daily and 4 hour provides stronger and more reliable reclaimed block because higher timeframe market structure is more reliable than lower timeframe structure. Lower timeframes are useful for scalping but it may have more false signals.

I’m Abdullah Shah, a content writer with three years of experience in crafting engaging and informative content. My background in market analysis complements my work, allowing me to create content that resonates with audiences. I’m also a seasoned practitioner in the forex and crypto markets, with a strong foundation and deep interest in finance. My passion for the financial world drives me to produce content that is both insightful and valuable for those interested in understanding market trends and financial strategies.