Table of Contents

ICT trading models are based on existing ICT concepts. There is nothing special in these models. It would be correct to say that it is the confluence of multiple ICT Concepts. ICT unicorn model is well-known and provide much better trading opportunities. Unicorn model is a confluence of breaker block and Fair Value Gap.

This article will help in understanding unicorn model, its core components and unicorn model in bullish and bearish scenarios.

Understanding ICT Unicorn Model

ICT Unicorn Model is a refined trading concept that identifies high-probability trade setups. In this ICT Model, we combine two ICT concepts: fair value gap and breaker blocks. This is a zone of confluence that combines FVG and Breaker Block. This overlap is used to identify and predict price movement and reaction. This is a unique method of finding opportunities in the financial markets.

A Fair Value Gap is a price imbalance that occurs when the market moves with such momentum that a gap forms between consecutive candles. These gaps indicate inefficiencies in price delivery, often revisited for correction, making them potential areas of interest for trade entries.

A breaker block represents a level of prior support or resistance invalidated by a strong price move, which subsequently acts as the opposite (support becomes resistance or vice versa). Breaker blocks are significant as they reflect areas of institutional interest.

This model emerges when FVG aligns with a breaker block. The zone serves as a supply or demand area for future price movements. The model is valuable because of its dual validation. When price retraces into the zone, it often signals a potential reversal or continuation. Remember, market reversal or continuation depends upon market structure.

Key Components of ICT Unicorn Model

The following are the smart money and ICT concepts that can be used along with ICT Unicorn Model:

- Foundation of ICT is understanding ICT market structure. Focus on the price movements. Notice Break of Structure and change of character. This helps trader identify bullish or bearish trend. Having understanding of market structure enables traders to trader with the dominant market direction.

- ICT emphasizes the role of liquidity in driving market movements. The model teaches traders to anticipate price movements towards these levels.

- FVG and Breaker Block are the key of the model. So, the overlap of ICT fair value gap and breaker block is crucial in this model.

These are the few concepts that can be combined with unicorn model. You can add more confluences with the trading strategy but remember keep you trading strategy clean and simple. It is an advance strategy that requires deep understanding and practice of ICT concepts. It offers immense potential for disciplined and well-informed trader.

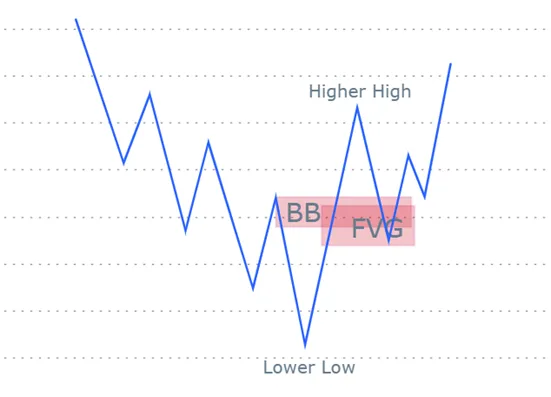

Bullish ICT Unicorn Model

Bullish Unicorn Model is a trading setup that signals a potential reversal from a bearish trend into a bullish trend. It forms at the end of a bearish price movement. As we know that the reliability stems from its confluence of a breaker block and FVG. In this case, it is a confluence of a bullish breaker block and a bullish fair value gap. This provides traders a precise area of interest for trade entries:

- Look for the formation of a lower low followed by a higher high. Bullish unicorn model begins with the market forming a lower low. Subsequently, the market makes a higher high by breaking the previous bearish structure. It signals an early shift in direction.

- Second most important thing is to look for bullish breaker block and bullish fair value gap. The overlap between the breaker block and FVG creates a zone of confluence. This is known as bullish unicorn zone. There is a possibility that price is likely to react when retraces to the area.

- Final step is to look for retest and confirmation. Price retraces to the overlapped area and confirm its validity as support. The successful retest of the area strengthens the bullish unicorn setup. The model offers high-probabilities trade entries.

By combing the structure with the overlap of Breaker block and FVG, the bullish unicorn not only signals a potential trend reversal but also provides a precise and reliable framework for identifying optimal trade opportunities.

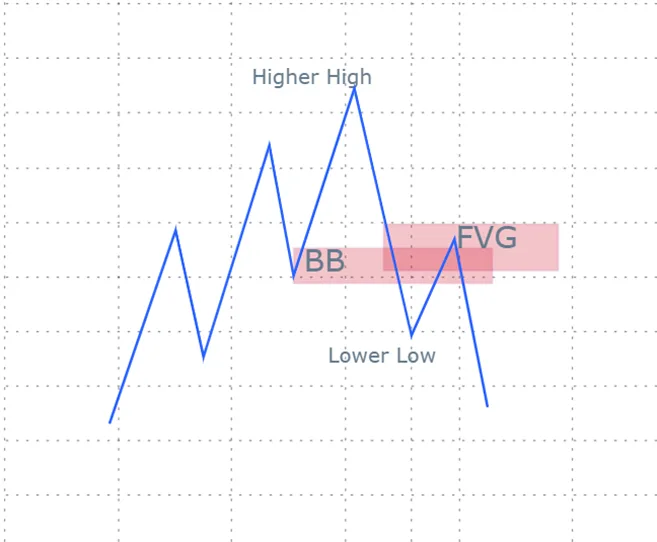

Bearish ICT Unicorn Model

Bullish Unicorn Model is a trading setup that signals a potential reversal from a bullish trend into a bearish trend. It forms at the end of a bullish price movement. As we know that the reliability stems from its confluence of a breaker block and FVG. In this case, it is a confluence of a bearish breaker block and a bearish fair value gap. This provides traders a precise area of interest for trade entries:

- Look for the formation of a higher high followed by a lower low. Bearish unicorn model begins with the market forming a higher high. Subsequently, the market makes a lower low by breaking the previous bullish structure. It signals an early shift in direction.

- Second most important thing is to look for bearish breaker block and bearish fair value gap. The overlap between the breaker block and FVG creates a zone of confluence. This is known as bearish unicorn zone. There is a possibility that price is likely to react when retraces to the area.

- Final step is to look for retest and confirmation. Price retraces to the overlapped area and confirm its validity as resistance. The successful retest of the area strengthens the bearish unicorn setup. The model offers high-probabilities trade entries.

By combing the structure with the overlap of Breaker block and FVG, the bearish unicorn not only signals a potential trend reversal but also provides a precise and reliable framework for identifying optimal trade opportunities.

Trading with ICT Unicorn Model

Trading with Unicorn model is not a daunting task. However, you have to be clear about market structure and daily bias. These things must be accurate.

After finding market structure and daily bias, wait for the price to approach Premium or discount (depending upon the market structure). When price approaches the PD array, wait for the market structure shift.

When price shift its structure from bullish to bearish or bearish to bullish, identify the ICT Unicorn Model. There you look for the price retracement in the unicorn model.

When price approaches the zone, you can execute the trade. Your stop-loss will be 10/20 pips below the low of the candle (in case of bullish unicorn model) or above the high of the candle which creates Fair value gap. Your take profit will be the next liquidity area.

Final Note

The ICT Unicorn Model is a powerful tool for identifying high-probability trade setups, particularly trend reversals. By combining the concepts of fair value gaps and breaker blocks, it highlights areas of confluence where price is likely to react. However, no model guarantees success, as market conditions can be unpredictable.

Risk Disclosure: Trading involves significant financial risk and may not be suitable for all investors. The ICT Unicorn Model requires proper analysis, risk management, and practice. Traders should use stop-loss orders and never risk more than they can afford to lose. Past performance is not indicative of future results.

Frequently Asked Questions (FAQs)

What is the ICT Unicorn Model?

The ICT Unicorn Model combines the concepts of Fair Value Gaps (FVGs) and breaker blocks to identify high-probability trade zones. This overlapping area acts as a strong indicator of potential support or resistance.

How does the Bullish Unicorn form?

The Bullish Unicorn forms at the end of a bearish trend when:

A lower low is followed by a higher high (shift in market structure).

A bullish breaker block overlaps with a bullish FVG.

Price successfully retests the overlapped zone, confirming the setup.

Which timeframe is best for ICT unicorn Model?

It depends upon the type of trading. However, this model is used for trade entries that why lower timeframe would be beneficial for trading unicorn model.

I’m Aatiq Shah, a dedicated forex and crypto market practitioner with three years of hands-on experience. Currently, I’m working as a Financial Manager. My journey in the world of finance has equipped me with the skills and knowledge needed to navigate the complexities of the forex and crypto markets.