Michael J. Huddleston, commonly known as The ICT (Inner Circle Trader), introduced a powerful PD array known as ICT suspension block. This PD array has become an essential tool for traders seeking precision entries in their trading.

This guide explores the concept of suspension block in trading, its identification, and more importantly effective trading with bullish and bearish suspension blocks.

Table of Contents

What is ICT Suspension Block?

ICT suspension Block is a unique price action pattern that get its name from being “suspended” between two volume imbalances. In suspension block, one volume imbalance is positioned above and another below the candlestick.

This unique formation creates a powerful zone that acts similar to FVGs but with its own unique characteristics. The key defining features of a suspension block include:

- A single candlestick with volume imbalances on both top and bottom.

- The candle’s body is completely overlapped by a wick from the candle on its left side.

- No FVG formation is possible due to the wick overlap.

- The body, combined with both volume imbalances, create an important zone for price reversal.

A volume imbalance represents a price inefficiency occurring when buy and sell orders fail to match efficiently, creating a body-to-body gap between consecutive candles.

Types of Suspension Blocks

Depending on market scenarios, there are two types of suspension blocks, each serve different market conditions and directional bias.

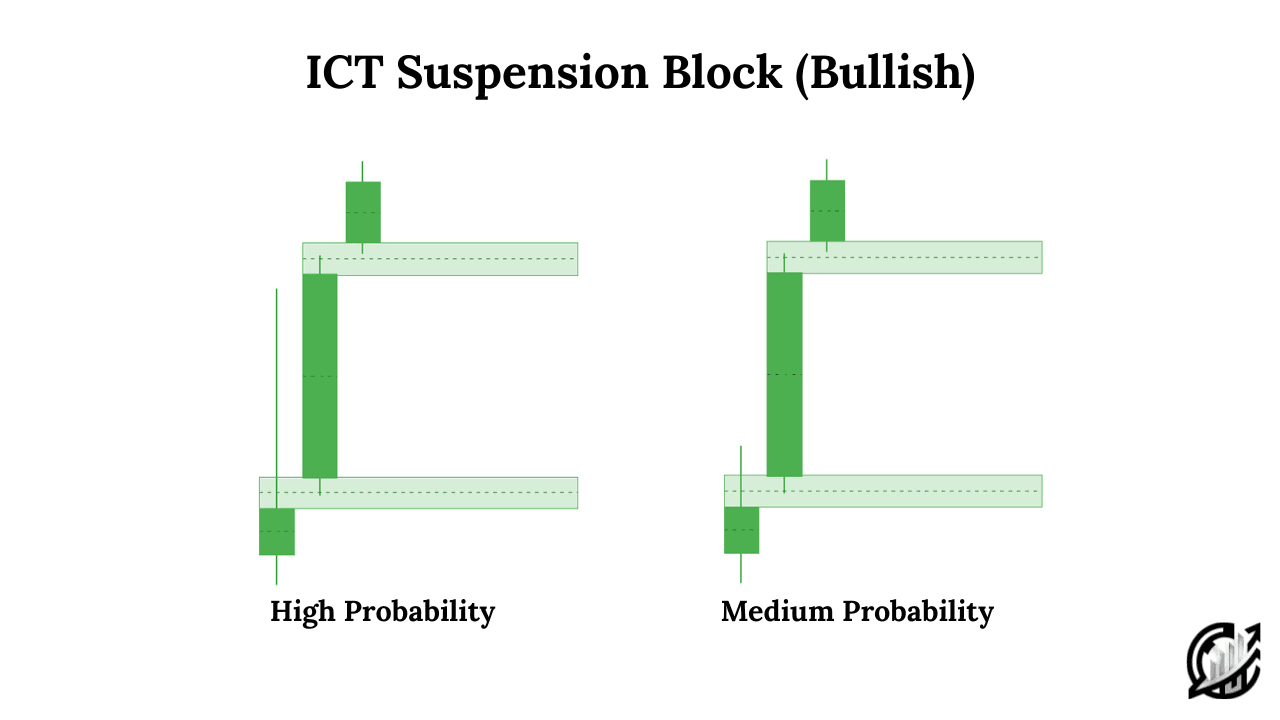

Bullish Suspension Block

A bullish suspension block is characterized by a bullish candlestick that has a volume imbalance at the top and another at the bottom. Bullish Suspension Blocks are more important when their bodies are completely covered by the wicks of the candle on its left side.

This formation acts as a potential buy zone in bullish market conditions.

When price retraces to a bullish suspension block, it is important to look for market structure shift. After establishing a bullish MSS, traders can look for buying opportunities.

The bullish suspension block becomes extremely important when forms in discount areas of a higher timeframe, offering confluence for long entries. Traders normally wait for price to tap into this zone before executing buy orders.

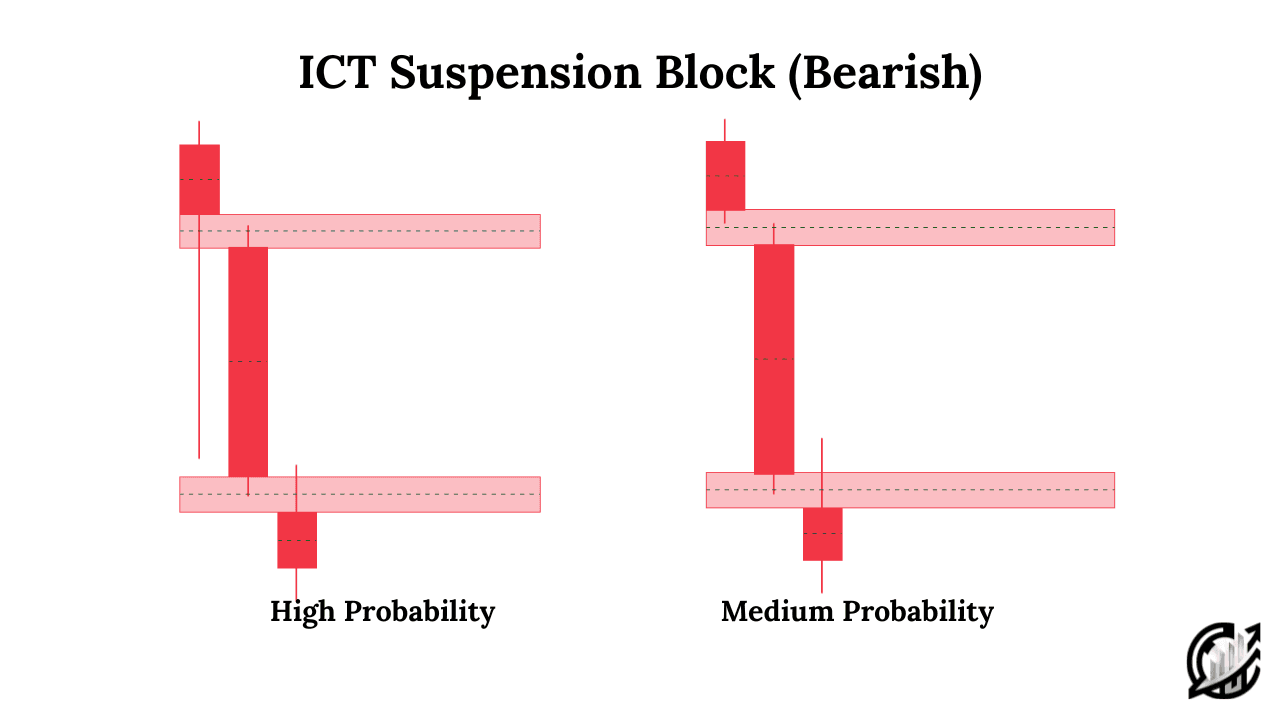

Bearish Suspension Block

Conversely, in bearish suspension block, a bearish candlestick forms with volume imbalance at both the top and bottom. Bearish suspension blocks are more important when their bodies are completely overlapped by the wick of the candle on its left side.

This pattern functions as a potential sell zone in bearish market conditions. After a bearish MSS, traders anticipate for selling opportunities.

The bearish suspension block carries weight when it forms in premium areas of a higher timeframe. This provides additional confirmation for short positions.

How to Trade ICT Suspension Block

Suspension Block is a precise PD array for trade entries and order execution. Suspension block functions similar to other ICT concepts like FVGS, Order Block, and Breaker Block.

Trading with Bullish Suspension Block

When implementing a bullish suspension block trading strategy, it is important to follow these systematic steps:

In step one, identify the market context. As an ICT trader, begin your analysis by analyzing the higher timeframe to ensure that the overall market structure is bullish. Look for price trading in discount areas. This increases the probability of upward movement.

In second step, identify the suspension block. As an ICT trader, locate a bullish suspension block that formed during the move.

In third step, wait for retracement. Exercise patience as price retraces back towards the suspension block. Do not chase the market; allow it to come to your predetermined zone.

In fourth step, shift to lower timeframe and wait for MSS towards upside. When MSS occurs, execute the trade.

In trading with bullish suspension block, place your stop loss below the suspension block candle or below the recent swing low. Placing a stoploss is entirely dependent on your risk tolerance and account management rules.

Trading with Bearish Suspension Block

When implementing a bearish suspension block trading strategy, it is important to follow these systematic steps:

In step one, ensure that the overall market structure is bearish. Look for price trading in premium areas. This increases the probability of downward movement.

In second step, identify the suspension block. As an ICT trader, locate a bearish suspension block that formed during the move.

In third step, wait for retracement. Exercise patience as price retraces back towards the suspension block. Do not chase the market; allow it to come to your predetermined zone.

In fourth step, shift to lower timeframe and wait for MSS towards downside. When MSS occurs, execute the sell trade.

In trading with bearish suspension block, place your stop loss above the suspension block candle or above the recent swing high. Place stoploss according to your risk tolerance.

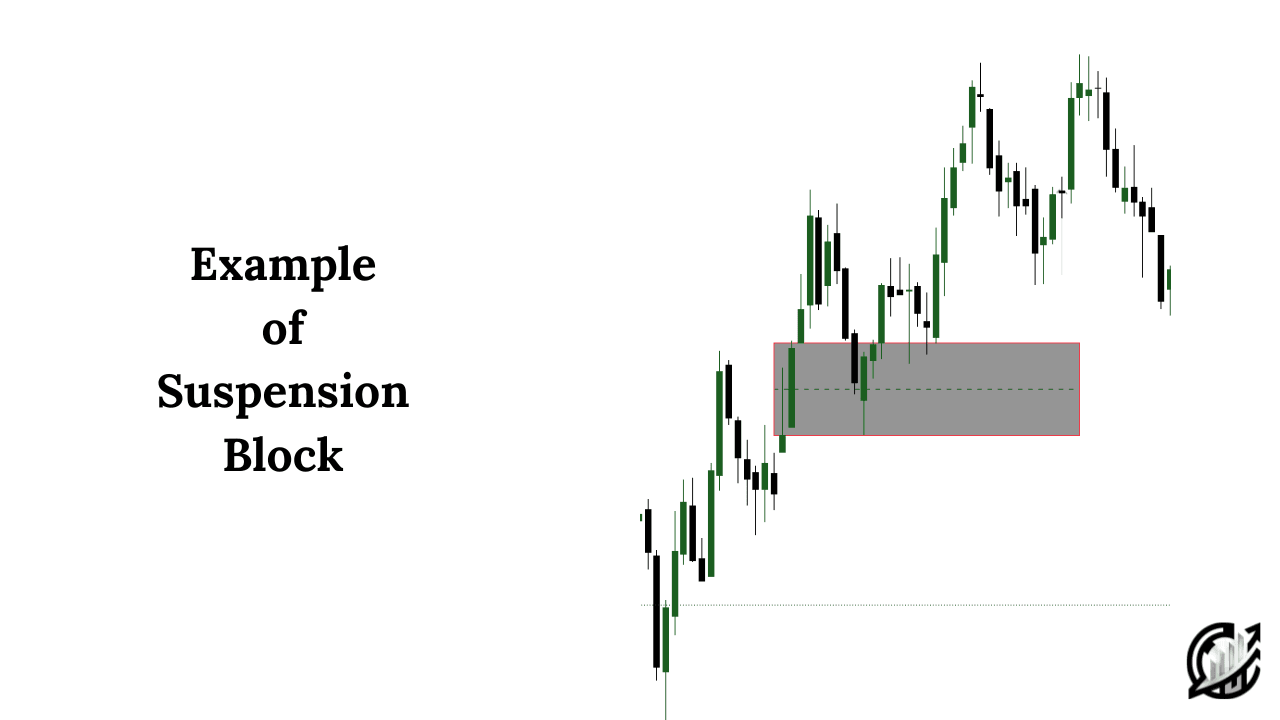

Example of Suspension Block

To better understand the suspension block, here is the practical application:

In the above chart, market is clearly in a bullish trend on the 4-hour chart. During the impulsive move, you can notice a bullish candle whose body is completely overlapped by the previous candle’s wick.

You can identify a volume imbalance above this candle and another volume imbalance below it.

This is your suspension block. When price retraces to the suspension block, there is a clear rejection and price continue its upward trend.

Final Thoughts

The ICT suspension block is a powerful PD array in SMC trading. Suspension blocks offer high-probability entry zones. By understanding the relationship between volume imbalances and the unique formation of the suspension block, you can enhance your trading precision.

Remember that the suspension block in trading is not a standalone PD array but rather a component of structured trading. With consistent practice and proper application, ICT suspension block can become a valuable tool in your trading journey.

I’m Abdullah Shah, a content writer with three years of experience in crafting engaging and informative content. My background in market analysis complements my work, allowing me to create content that resonates with audiences. I’m also a seasoned practitioner in the forex and crypto markets, with a strong foundation and deep interest in finance. My passion for the financial world drives me to produce content that is both insightful and valuable for those interested in understanding market trends and financial strategies.