Table of Contents

Prediction and forecast in trading is one hundred percent dependent on data. This data can be technical and fundamental. As far as technical data is concerned, every candle, every level, and every number on chart tells a story. Among these critical reference points, two are known for their consistency, reliability, and strategic importance: Previous Day High (PDH), and Previous Day Low (PDL).

In SMC and ICT trading methodologies, there are price levels that act as magnet for liquidity and manipulation. Previous day high and low are the most important level in this regard. These levels are also known as institutional manipulation zones.

This article explores an understanding of previous day high and low in the context of SMC and ICT trading, its exploitation, and how it can help us in trading.

What is the Previous Day High and Low?

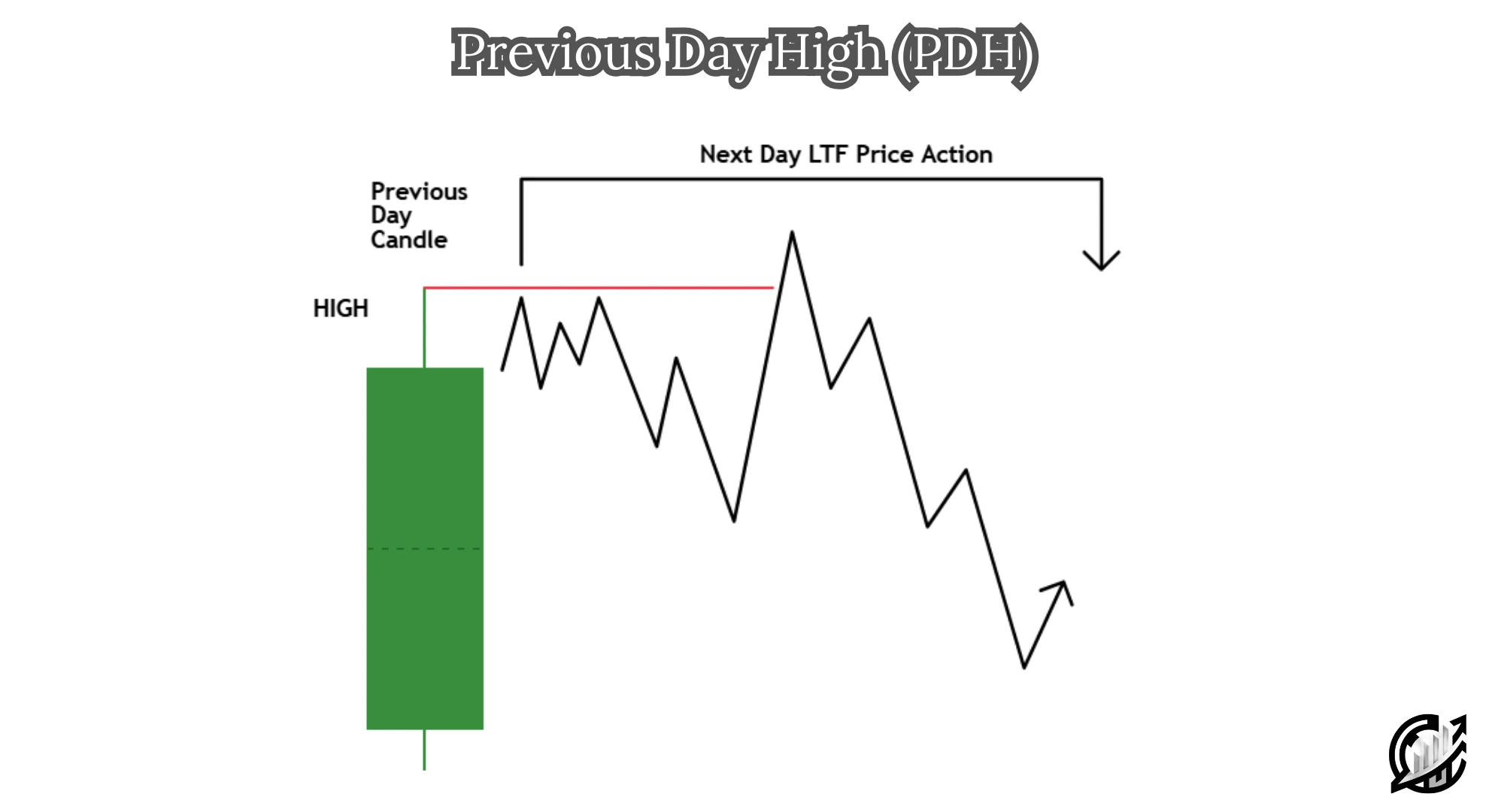

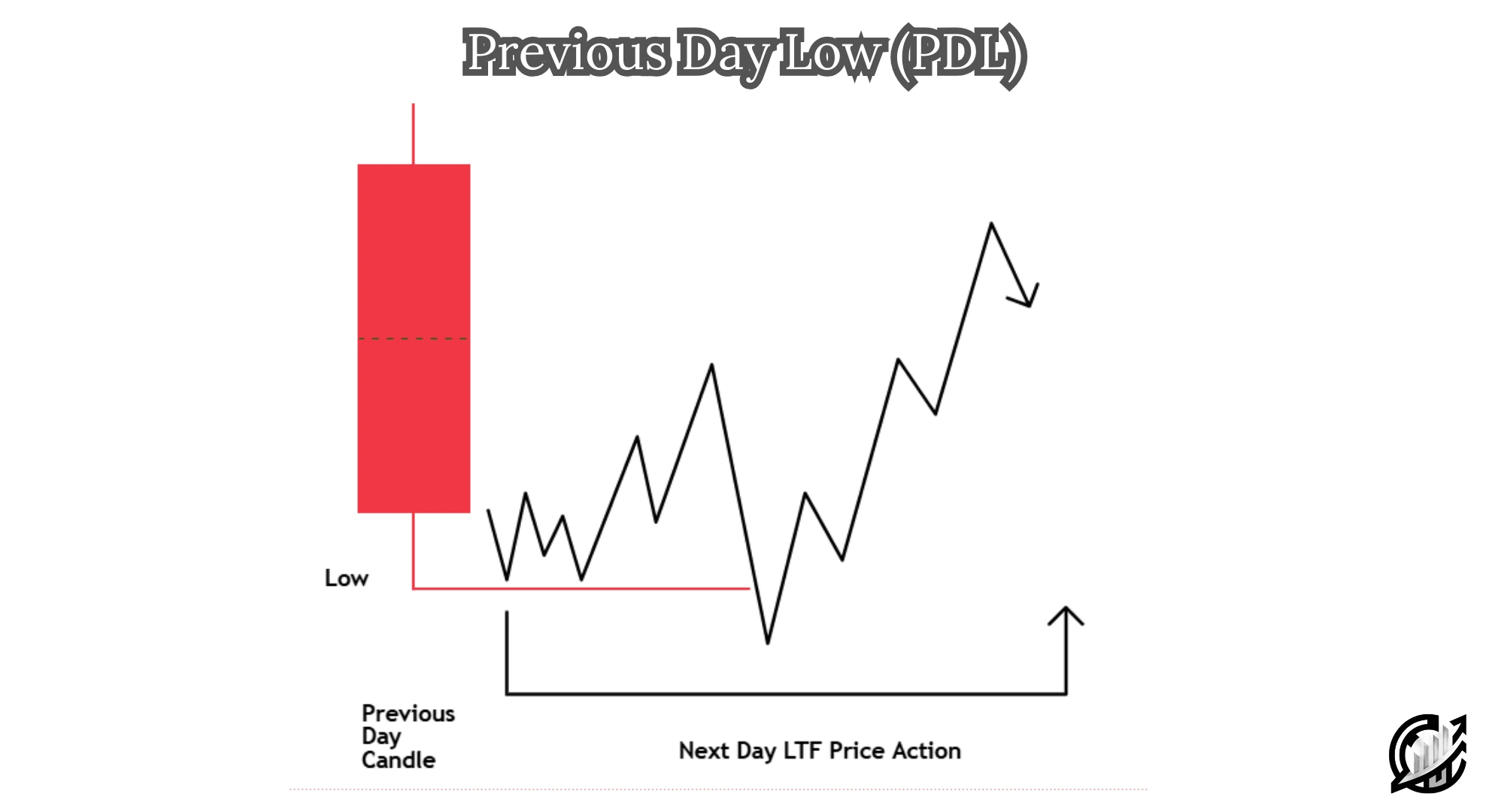

Simply, the previous day high (PDH) is the highest price level the price reached during the previous trading day. Conversely, the previous day low (PDL) is the lowest price reached during the same day. These two levels form a range that can help traders evaluate the market’s directional bias and predict potential reversals.

In traditional trading, these levels are just viewed as resistance or support levels. In SMC and ICT trading, these are liquidity targets for institutional traders.

In technical terms, PDH and PDL are external range liquidity. The market tends to sweep these levels to grab liquidity, induce retail traders, and reverse price after manipulation.

Why are PDH and PDL Important?

The previous day high and low are important because they are not just support and resistance areas but psychological areas. These following the reasons PDH and PDL are considered as important:

- These levels are often used as liquidity zones. Before reversing, market often sweep liquidity above or below these areas.

- Not all traders trade in swing style. Day traders used these levels for intraday trading. Mostly, they look for breakouts and reversal.

- Using the levels, you can understand market bias. Breaking above PDH with strong displacement candle, aka institutional funding candle, suggest bullish potential continuation.

- This helps in trading with specific bias. You can set predefined risk management. This allows traders to place well-defined stop-loss and take-profit level. This helps in building disciplined and rule-based trading.

In trading, you need to are about each and every single point. Remember, leaving a single point will cost you dollars. Although mistakes are common and natural for human being. However, understanding these simple things aware about mistakes.

What is SMC Perspective about PDH and PDL?

Things in trading are not static. One strategy can be used in many ways. Similarly, PDH and PDL can be view differently by SMC and ICT traders.

PDH and PDL are level where the most visible liquidity retail stop-losses sit. Smart money and institutions know that beginner traders set their stop-losses above yesterday’s high or below yesterday’s low. Institutions target these levels to fill their orders at optimal price.

Price often visits these areas to sweep liquidity and then reverse in its intended direction. After sweeping liquidity, if price shows a change of character (CHOCH), or market structure shifts (MSS). Liquidity sweep and MSS provides a powerful reversal entry opportunity.

According to ICT, market often seeks to engineer liquidity during key session like London trading session and New York trading session. Institutions can target these levels for manipulation and directional delivery.

It would not be incorrect to say that the core of SMC and ICT is Liquidity and manipulation supported by time perspective.

How PDH & PDL are used in SMC?

ICT traders use PDH and PDL as part of liquidity-based setups and time-sensitive trade executions. Well-known strategy is liquidity sweep and reversal setups.

Liquidity Sweep and Reversal Setup

It would not be incorrect to say that it is one of the most foundational ICT setups. Price often sweeps above PDH or below PDL to sweep liquidity or induce breakout buyers/sellers.

Smart money fill orders at a premium/discount. A change of character and MSS occurs on a lower timeframe.

After confirming price on lower timeframe, price starts its delivery in the opposite direction.

Break and Retest of PDH/PDL as Continuation Model

When the PDH or PDL is cleanly broken with displacement move, and price retest that level without sweeping back, it can act as a continuation point. The following are the strategy steps:

- Identify displacement above PDH or below PDL.

- Wait for a price to return and tap into an order block, FVG, or imbalance near that level.

- Enter with confirmation on LTF.

You must follow the rules of timeframe selection.

PDH/PDL as Internal vs. External Liquidity

In this context, internal range liquidity lies within the range of the day. For this purpose, we shift on lower timeframes for intraday highs and lows. External liquidity lies beyond the PDH/PDL.

There is an idea in SMC trading that trade from internal to external liquidity, and external to internal liquidity depending on price delivery. For example, after PDL sweep, price trades back towards internal liquidity.

Session Timing and the Role of PDH/PDL

Time of a day is a cornerstone of ICT’s philosophy. PDH and PDL behaves differently across sessions.

Asian Session often builds internal liquidity. It often sets up the range for later sweeps. London session tends to target one side of the liquidity. It may create inducement for New York.

In New York session most liquidity sweeps occur. It often targets the opposite side of London move.

These are basic and surface level concept of session timing. This is the possible scenario described. Market behavior cannot remain same. Difference are common in price action.

Common Mistakes

Human make mistakes in trading. Having a thorough study of trading scenarios and trading strategy can help you in minimizing trading mistakes. However, there are the following mistakes that traders must avoid:

- Not all sweeps indicate reversal. In trading, context is key. Look for change of character, MSS, FVG and order blocks before reacting.

- ICT trading is time-sensitive. If you are PDH/PDL outside London or NY session, changes of manipulation are lower.

- PDH/PDL sweeps must align with weekly bias, HTF liquidity, and imbalances.

- Wait for clear displacement of price, then react on the retracement.

Best Practices

- Always check daily bias.

- Align PDH/PDL with time of day.

- Watch for liquidity runs during news or sessions open.

- Use multi-timeframe confluence.

- Study 2-3 days price action data.

Final Note

The previous day high and low are not just static levels on price chart. These are the psychological levels and act as liquidity traps. These are the levels with full of trading opportunity. Align them with best practices and confirm trades on lower timeframes. Financial market carries significant risk. Before trading learn things and consult financial advisor. Never trade with the capital that you cannot afford to lose.

FAQs

Are PDH & PDL support and resistance?

Support and resistance zones are traditional trading concepts. In SMC and ICT trading, previous day high and low are liquidity pools. Before reversing, price sweeps liquidity above or below these levels.

When to trade PDH and PDL?

Before trading PDH or PDL, wait for confirmation setups. If you are expecting reversal after liquidity sweep, wait for MSS on smaller timeframes. Remember, ICT trading is time-sensitive. Liquidity sweeps are powerful in London or NY session.

Is time important in trading these levels?

Time is an important concept in ICT trading. You’ll find high-probability setups in London and New York kill zones.

I’m Abdullah Shah, a content writer with three years of experience in crafting engaging and informative content. My background in market analysis complements my work, allowing me to create content that resonates with audiences. I’m also a seasoned practitioner in the forex and crypto markets, with a strong foundation and deep interest in finance. My passion for the financial world drives me to produce content that is both insightful and valuable for those interested in understanding market trends and financial strategies.